Are you curious about what IPERS is and how it can shape your financial future? IPERS, or the Iowa Public Employees' Retirement System, is a cornerstone of retirement planning for public employees in Iowa. Whether you're a teacher, a government worker, or simply someone exploring retirement options, understanding IPERS is crucial for securing a stable financial future. This article will delve into the intricacies of IPERS, explaining its purpose, benefits, and how you can maximize your contributions. By the end of this guide, you'll have a comprehensive understanding of IPERS and how it fits into your retirement strategy.

IPERS serves as a defined benefit pension plan, providing retirement, disability, and survivor benefits to eligible public employees in Iowa. It is a vital resource for thousands of individuals, ensuring financial security during their post-employment years. With its structured framework and robust benefits, IPERS has become a trusted institution for public employees across the state.

In this article, we will explore the origins, structure, and benefits of IPERS in detail. From its history to its impact on retirement planning, we'll cover everything you need to know. Whether you're new to IPERS or looking to optimize your contributions, this guide will provide valuable insights to help you make informed decisions. Let's dive into the world of IPERS and uncover how it can benefit you.

Read also:Unlocking Convenience A Complete Guide To Vancouver Clinic Mychart App

Table of Contents

- What is IPERS?

- History of IPERS

- How IPERS Works

- Benefits of IPERS

- Eligibility Criteria

- Contribution Rates

- Retirement Options

- Disability Benefits

- Survivor Benefits

- Maximizing Your IPERS Benefits

What is IPERS?

IPERS, or the Iowa Public Employees' Retirement System, is a defined benefit pension plan designed to provide retirement, disability, and survivor benefits to eligible public employees in Iowa. Established to ensure financial security for public workers, IPERS operates as a trust fund, funded by contributions from both employees and employers. The system is governed by a board of trustees, ensuring transparency and accountability in managing the funds.

As a defined benefit plan, IPERS guarantees a specific monthly benefit upon retirement, calculated based on factors such as years of service and salary history. This structure provides peace of mind to employees, knowing they have a reliable source of income during their retirement years. IPERS also offers additional benefits, such as disability and survivor benefits, further enhancing its value to members.

Key Features of IPERS

- Defined benefit pension plan

- Guaranteed monthly retirement benefits

- Disability and survivor benefits

- Funded by employee and employer contributions

- Governed by a board of trustees

History of IPERS

IPERS was established in 1953, with the primary goal of providing financial security to public employees in Iowa. Over the decades, the system has evolved to meet the changing needs of its members, expanding its benefits and refining its structure. The growth of IPERS reflects its commitment to serving public employees and ensuring their financial well-being during retirement.

Initially, IPERS covered a limited number of employees, primarily teachers and state workers. However, as its importance became evident, the system expanded to include a broader range of public employees, such as municipal workers and law enforcement officers. This expansion has solidified IPERS as a critical component of retirement planning for public employees in Iowa.

Milestones in IPERS History

- 1953: Establishment of IPERS

- 1970s: Expansion to include municipal workers

- 1990s: Introduction of disability benefits

- 2000s: Implementation of survivor benefits

- 2020s: Focus on sustainability and modernization

How IPERS Works

IPERS operates as a defined benefit pension plan, meaning that the retirement benefits are predetermined based on a formula. This formula takes into account factors such as years of service, salary history, and a multiplier. Contributions to IPERS are made by both employees and employers, ensuring a steady flow of funds to support the system.

Upon retirement, members receive a monthly benefit, calculated using the formula mentioned above. The longer an individual contributes to IPERS and the higher their salary, the greater their retirement benefit will be. This structure incentivizes long-term employment and consistent contributions, aligning the interests of employees and employers.

Read also:Unlocking The Secrets To Achieving Stable Harmony In Life

Contribution Structure

- Employee contributions: A fixed percentage of salary

- Employer contributions: Varies based on actuarial assumptions

- Total contributions: Invested to generate returns

Benefits of IPERS

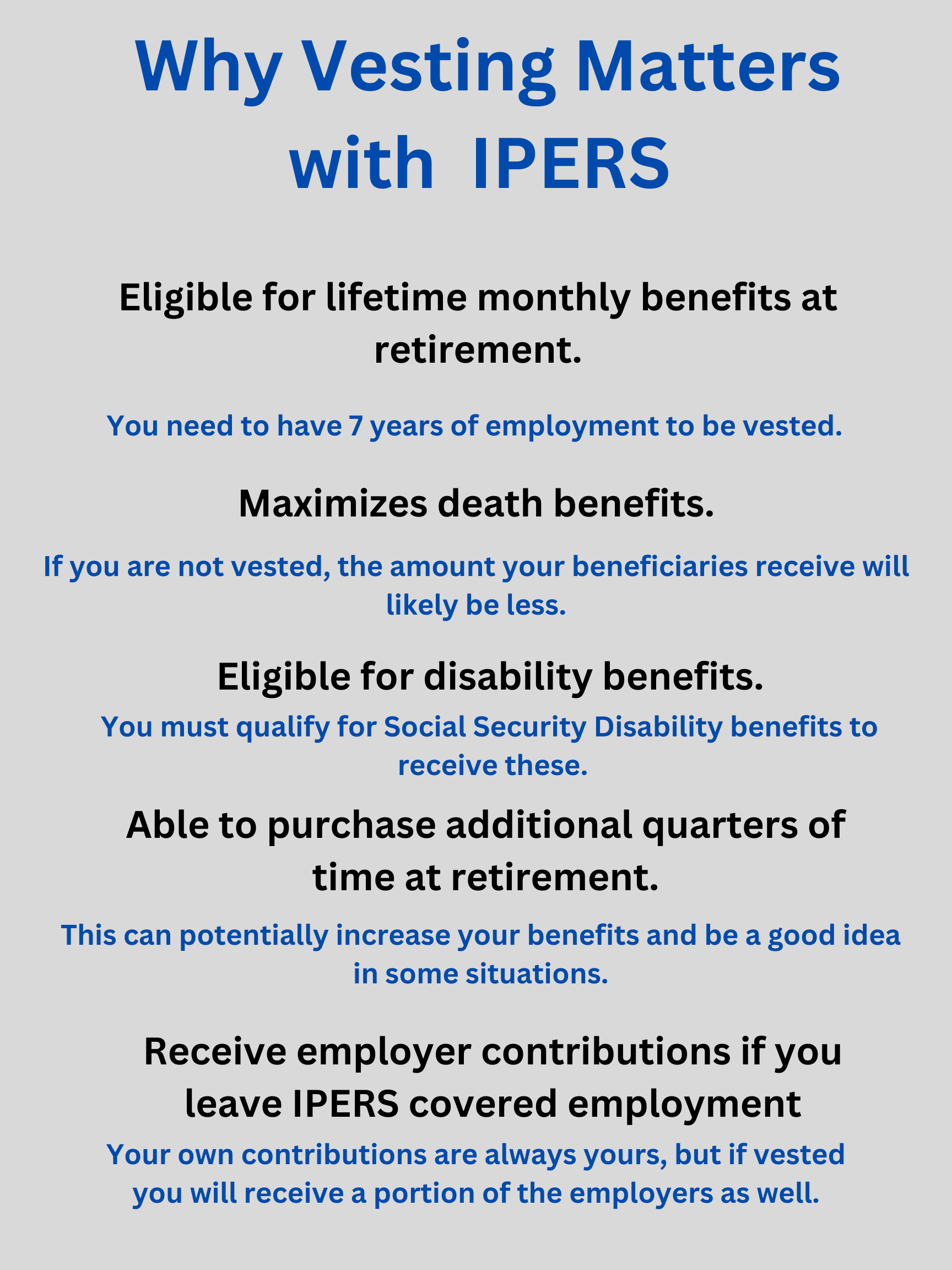

IPERS offers a range of benefits designed to provide financial security and peace of mind to its members. These benefits include retirement income, disability coverage, and survivor benefits, ensuring comprehensive support for public employees and their families. By participating in IPERS, members gain access to a reliable and predictable source of income during their retirement years.

One of the standout features of IPERS is its defined benefit structure, which guarantees a specific monthly payment upon retirement. This predictability allows members to plan their finances effectively, knowing they have a stable income stream. Additionally, IPERS provides disability benefits to members who are unable to work due to illness or injury, offering crucial financial support during challenging times.

Types of Benefits Offered by IPERS

- Retirement benefits

- Disability benefits

- Survivor benefits

- Health insurance subsidies (in some cases)

Eligibility Criteria

To qualify for IPERS benefits, individuals must meet specific eligibility criteria. These criteria include being employed by a participating public employer and contributing to the system for a minimum number of years. Understanding these requirements is essential for maximizing your benefits and ensuring you qualify for retirement income.

Eligibility for retirement benefits typically requires a minimum of five years of service. However, members can begin receiving benefits as early as age 55, provided they meet the service requirement. For disability benefits, members must demonstrate that they are unable to perform their job duties due to a medical condition. Survivor benefits are available to the spouses or dependents of deceased members, offering financial support to their families.

Eligibility Requirements

- Employment with a participating public employer

- Minimum of five years of service for retirement benefits

- Proof of disability for disability benefits

- Relationship to a deceased member for survivor benefits

Contribution Rates

Contributions to IPERS are a shared responsibility between employees and employers. Employee contributions are calculated as a fixed percentage of their salary, while employer contributions vary based on actuarial assumptions and the financial health of the system. These contributions are invested to generate returns, ensuring the sustainability of IPERS for future generations.

As of the latest updates, employee contribution rates are set at 7.4% of salary, while employer contributions are determined annually based on actuarial valuations. These rates are subject to change, reflecting the evolving financial landscape and the need to maintain the system's solvency. By understanding the contribution structure, members can better plan their finances and contributions to IPERS.

Current Contribution Rates

- Employee contribution: 7.4% of salary

- Employer contribution: Varies annually

- Total contributions: Invested for long-term growth

Retirement Options

IPERS offers several retirement options to accommodate the diverse needs of its members. These options include traditional retirement benefits, early retirement provisions, and alternative payment plans. By understanding these options, members can choose the plan that best aligns with their financial goals and retirement timeline.

Traditional retirement benefits are available to members who meet the eligibility criteria and choose to retire at the standard retirement age. Early retirement provisions allow members to begin receiving benefits before the standard retirement age, albeit with reduced monthly payments. Alternative payment plans, such as lump-sum distributions, provide flexibility for members seeking different payout structures.

Available Retirement Options

- Traditional retirement benefits

- Early retirement provisions

- Alternative payment plans

- Survivor annuity options

Disability Benefits

IPERS provides disability benefits to members who are unable to work due to a medical condition. These benefits offer financial support during times of illness or injury, ensuring that members can maintain their quality of life despite unforeseen circumstances. To qualify for disability benefits, members must meet specific criteria and provide medical documentation supporting their claim.

Disability benefits are calculated based on the member's salary and years of service, similar to retirement benefits. Members who qualify for disability benefits receive a monthly payment, which can be a lifeline during challenging times. Additionally, IPERS offers resources and support to help members navigate the application process and access the benefits they deserve.

Key Features of Disability Benefits

- Financial support for medical conditions

- Monthly payments based on salary and service

- Medical documentation required

- Resources and support for members

Survivor Benefits

Survivor benefits are a critical component of IPERS, providing financial support to the spouses or dependents of deceased members. These benefits ensure that families are protected in the event of a member's passing, offering peace of mind and financial security. Survivor benefits are available to eligible beneficiaries, including spouses, children, and other dependents.

The amount of survivor benefits is determined based on the member's contributions and years of service. Beneficiaries receive monthly payments, which can be a vital source of income during difficult times. IPERS also offers resources and support to help beneficiaries understand their rights and access the benefits they are entitled to.

Eligibility for Survivor Benefits

- Spouses, children, and dependents of deceased members

- Monthly payments based on contributions

- Resources and support for beneficiaries

Maximizing Your IPERS Benefits

To make the most of your IPERS benefits, it's essential to understand the system and plan your contributions strategically. By maximizing your contributions and understanding the available options, you can ensure a secure and comfortable retirement. Here are some tips for maximizing your IPERS benefits:

- Contribute consistently: Regular contributions increase your retirement benefits.

- Understand your options: Explore retirement and payment options to find the best fit.

- Plan for the long term: Consider your retirement goals and plan accordingly.

- Stay informed: Keep up with updates and changes to IPERS policies.

Conclusion

In conclusion, IPERS is a vital resource for public employees in Iowa, offering retirement, disability, and survivor benefits. By understanding how IPERS works and maximizing your contributions, you can secure a stable financial future. Whether you're planning for retirement or exploring your options, IPERS provides the tools and support you need to succeed.

We hope this guide has provided valuable insights into what IPERS is and how it can benefit you. If you found this article helpful, please consider sharing it with others or leaving a comment below. For more information on retirement planning and financial security, explore our other articles and resources. Your financial future starts today—make the most of it with IPERS!