Professional liability insurance HPSO is a crucial aspect of risk management for professionals across various industries. Whether you're a healthcare provider, consultant, or legal practitioner, understanding this type of insurance can protect your career and financial stability. This article dives deep into the world of professional liability insurance HPSO, exploring its benefits, coverage details, and why it's essential for your professional journey.

In today's litigious society, even the most diligent professionals can find themselves facing lawsuits. These claims can arise from perceived errors, omissions, or negligence in professional services. Without adequate protection, such legal challenges can devastate your practice and personal finances. This is where professional liability insurance HPSO comes into play, offering specialized coverage designed specifically for professionals.

As we explore this topic, we'll examine how HPSO has established itself as a trusted provider in the professional liability insurance market. We'll also discuss how their policies are structured, what they cover, and why choosing the right coverage is vital for maintaining your professional reputation and peace of mind.

Read also:What Is Fudgie Discover The Sweet Secrets Behind This Trendy Treat

Table of Contents

- What is Professional Liability Insurance?

- Understanding HPSO Insurance

- Coverage Details and Policy Options

- Key Benefits of HPSO Professional Liability Insurance

- Eligibility Requirements and Application Process

- Factors Affecting Insurance Costs

- Understanding the Claims Process

- Industry-Specific Coverage Options

- Customer Support and Resources

- Conclusion and Next Steps

What is Professional Liability Insurance?

Professional liability insurance, often referred to as errors and omissions insurance, is a specialized form of coverage that protects professionals against claims of negligence or mistakes in their professional services. Unlike general liability insurance, which covers bodily injury and property damage, professional liability insurance HPSO focuses specifically on the unique risks faced by professionals.

This type of insurance typically covers:

- Legal defense costs

- Judgments and settlements

- Claims of professional negligence

- Errors in professional advice or services

- Omissions or mistakes in service delivery

Professional liability insurance HPSO is particularly important because it provides protection against claims that could otherwise result in significant financial losses. The coverage extends beyond just monetary protection, offering peace of mind and allowing professionals to focus on their work without constant worry about potential lawsuits.

Understanding HPSO Insurance

HPSO (Healthcare Providers Service Organization) has established itself as a leading provider of professional liability insurance for healthcare professionals and other specialists. Founded in 1980, HPSO has built a strong reputation for offering comprehensive coverage solutions tailored to the specific needs of various professional groups.

Company Background and Expertise

HPSO operates as a program administrator, partnering with established insurance carriers to provide specialized coverage. Their expertise spans multiple professional sectors, including:

- Healthcare professionals

- Consultants

- IT professionals

- Legal practitioners

- Educational professionals

What sets HPSO apart is their deep understanding of the unique risks faced by different professional groups. They've developed specialized insurance products that address specific industry challenges and regulatory requirements.

Read also:Discover Nycs Culinary Gems A Food Lovers Paradise

Coverage Details and Policy Options

Professional liability insurance HPSO offers several key coverage features that make it attractive to professionals:

Core Coverage Components

The standard policy typically includes:

- Defense costs coverage

- Judgments and settlements

- Claims-made coverage

- Tail coverage options

- Worldwide coverage

Policy limits can range from $100,000 to $5 million or more, depending on the professional's needs and risk exposure. HPSO also offers additional coverage options, including:

Optional Coverage Enhancements

- Cyber liability protection

- Employment practices liability

- Regulatory protection

- License protection

These additional coverages help professionals address modern risks that weren't as prevalent when traditional liability insurance was first developed.

Key Benefits of HPSO Professional Liability Insurance

Choosing professional liability insurance HPSO offers several distinct advantages:

Industry-Specific Expertise

HPSO's deep understanding of various professional sectors allows them to craft policies that address specific industry challenges. For example:

- Healthcare professionals benefit from coverage that understands HIPAA requirements

- IT professionals receive protection against data breach claims

- Consultants gain coverage for advice-related errors

Claims Support and Resources

HPSO provides exceptional claims support, including:

- 24/7 claims reporting

- Access to experienced claims professionals

- Legal defense resources

- Risk management tools

Their extensive network of defense attorneys and claims specialists ensures that policyholders receive expert guidance throughout the claims process.

Eligibility Requirements and Application Process

While specific requirements vary by profession, general eligibility criteria for professional liability insurance HPSO include:

- Active professional license (if required)

- Minimum education requirements

- Clean claims history

- Professional experience

The application process typically involves:

- Completing an online application

- Providing professional credentials

- Submitting claims history

- Reviewing coverage options

HPSO's underwriting process is designed to be efficient while ensuring appropriate risk assessment.

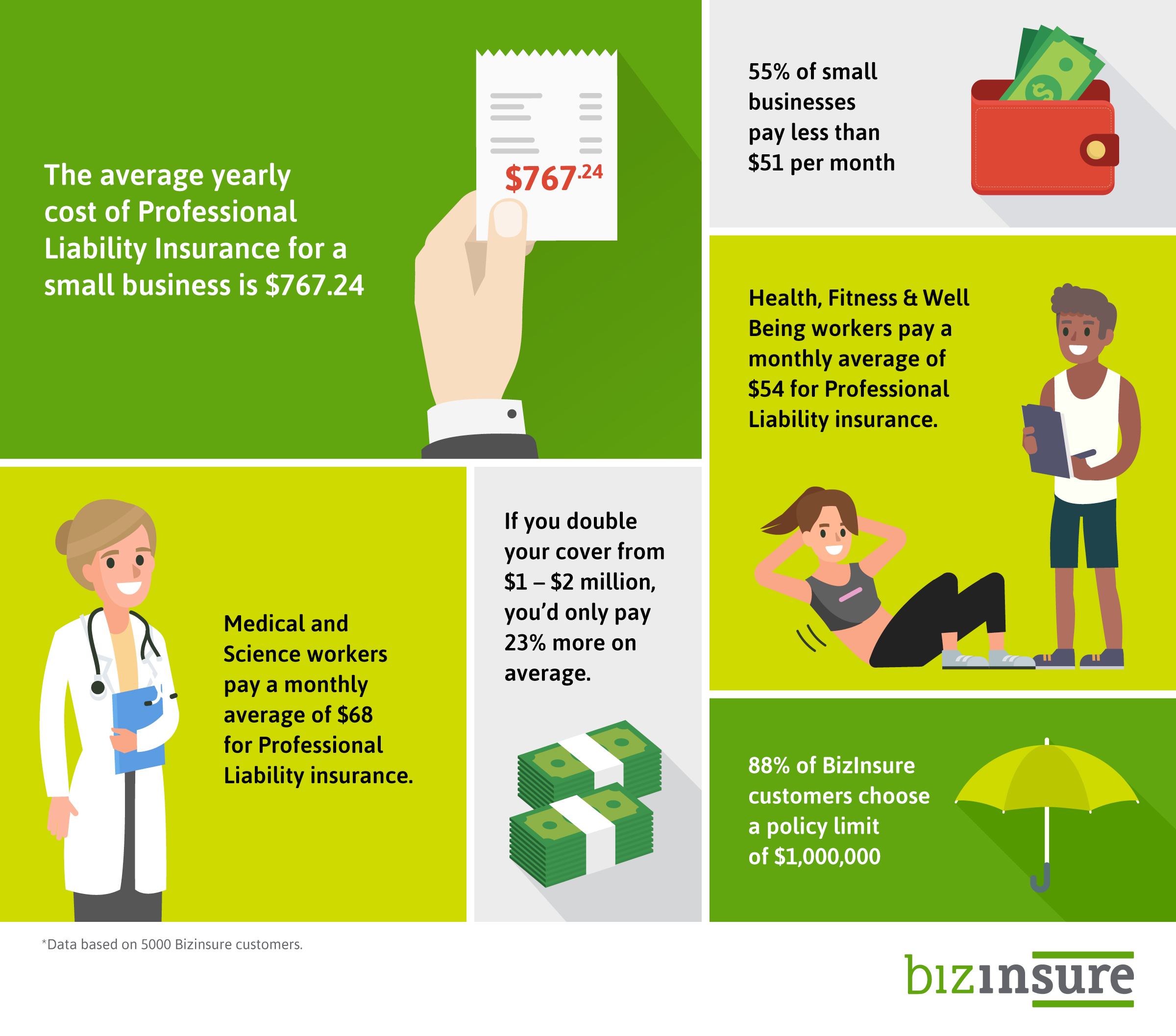

Factors Affecting Insurance Costs

Several key factors influence the cost of professional liability insurance HPSO:

Premium Determinants

- Professional specialty and risk profile

- Years of experience

- Claims history

- Location of practice

- Scope of services offered

Typical premium ranges vary significantly by profession:

| Profession | Annual Premium Range |

|---|---|

| Physicians | $6,000 - $50,000+ |

| Nurses | $1,500 - $3,500 |

| IT Consultants | $2,500 - $7,500 |

| Business Consultants | $2,000 - $6,000 |

Discounts are often available for:

- Part-time practice

- Claims-free history

- Group policies

- Risk management participation

Understanding the Claims Process

HPSO has developed a streamlined claims process to ensure policyholders receive prompt assistance:

Claims Reporting Procedure

- Immediate notification through 24/7 hotline

- Assignment of dedicated claims specialist

- Collection of relevant documentation

- Initial assessment within 48 hours

Claims Management Features

- Access to nationwide network of defense attorneys

- Claims monitoring and updates

- Settlement negotiation support

- Appeals process assistance

Their experienced claims team works closely with policyholders to achieve the best possible outcomes while minimizing stress and disruption.

Industry-Specific Coverage Options

Professional liability insurance HPSO offers tailored solutions for various industries:

Healthcare Professionals

- Medical malpractice coverage

- HIPAA violation protection

- Telemedicine coverage

- Scope of practice protection

IT and Technology Professionals

- Cyber liability protection

- Software implementation errors

- Data breach coverage

- System integration protection

Consulting and Business Services

- Advice and guidance protection

- Project management errors

- Financial advice coverage

- Contractual liability protection

Customer Support and Resources

HPSO provides comprehensive support services to help policyholders manage their risk effectively:

Support Channels

- 24/7 customer service hotline

- Online policy management portal

- Dedicated account managers

- Claims assistance specialists

Risk Management Resources

- Online training modules

- Industry-specific risk management guides

- Monthly newsletters

- Compliance updates

These resources help professionals stay informed about emerging risks and best practices in their respective fields.

Conclusion and Next Steps

Professional liability insurance HPSO offers comprehensive protection that's essential for modern professionals. From its industry-specific coverage options to its robust claims support system, HPSO provides peace of mind and financial security in an increasingly complex professional landscape.

As we've explored throughout this article, investing in professional liability insurance HPSO is more than just a financial decision – it's a crucial step in protecting your career, reputation, and future. The coverage options, combined with HPSO's expertise and support resources, make it an excellent choice for professionals seeking reliable protection.

We encourage you to take the next step in securing your professional future. Consider reaching out to HPSO for a personalized quote and consultation. Additionally, feel free to share your thoughts or questions in the comments below, and explore our other articles for more insights on professional risk management strategies.