Buying a home is one of the most significant financial decisions you’ll ever make, and knowing how much house you can afford is crucial to making a smart choice. With so many variables involved—mortgage rates, down payments, monthly expenses—it’s easy to get overwhelmed. That’s where tools like the home affordability calculator nerdwallet offers come into play. These calculators simplify the process, helping you determine what you can comfortably afford without jeopardizing your financial stability. Whether you’re a first-time buyer or looking to upgrade, understanding your budget is the first step toward homeownership success.

What makes the home affordability calculator nerdwallet provides so valuable? For starters, it’s user-friendly and designed to give you personalized results based on your unique financial situation. By inputting details like your income, monthly debts, and down payment amount, you can get an accurate estimate of the price range for homes that fit your budget. This not only saves time but also helps you avoid falling in love with a house that’s out of reach. Additionally, the calculator considers factors like interest rates and loan terms, giving you a comprehensive view of your financial picture.

With the housing market constantly evolving, having access to reliable tools is essential. The home affordability calculator nerdwallet offers isn’t just about crunching numbers—it’s about empowering you to make informed decisions. By leveraging this resource, you can confidently navigate the home-buying process and ensure you’re investing in a property that aligns with your long-term goals. Let’s dive deeper into how this tool works and explore strategies to maximize its benefits.

Read also:Is Jeff Bezos Of Jewish Descent Unraveling The Truth Behind His Heritage

Table of Contents

- What Is a Home Affordability Calculator?

- How Does the Home Affordability Calculator NerdWallet Work?

- Why Is It Important to Know How Much House You Can Afford?

- What Factors Should You Consider Before Using a Calculator?

- How Can You Improve Your Chances of Buying a Home?

- Common Mistakes to Avoid When Using a Home Affordability Calculator

- What Are the Benefits of Using NerdWallet’s Calculator?

- Frequently Asked Questions About Home Affordability

What Is a Home Affordability Calculator?

A home affordability calculator is an online tool designed to help potential homebuyers estimate how much house they can afford based on their financial situation. These calculators take into account various factors such as your annual income, monthly debts, down payment amount, and current mortgage rates to provide a realistic price range for homes that fit your budget. Essentially, they act as a financial compass, guiding you through the often-complex world of real estate.

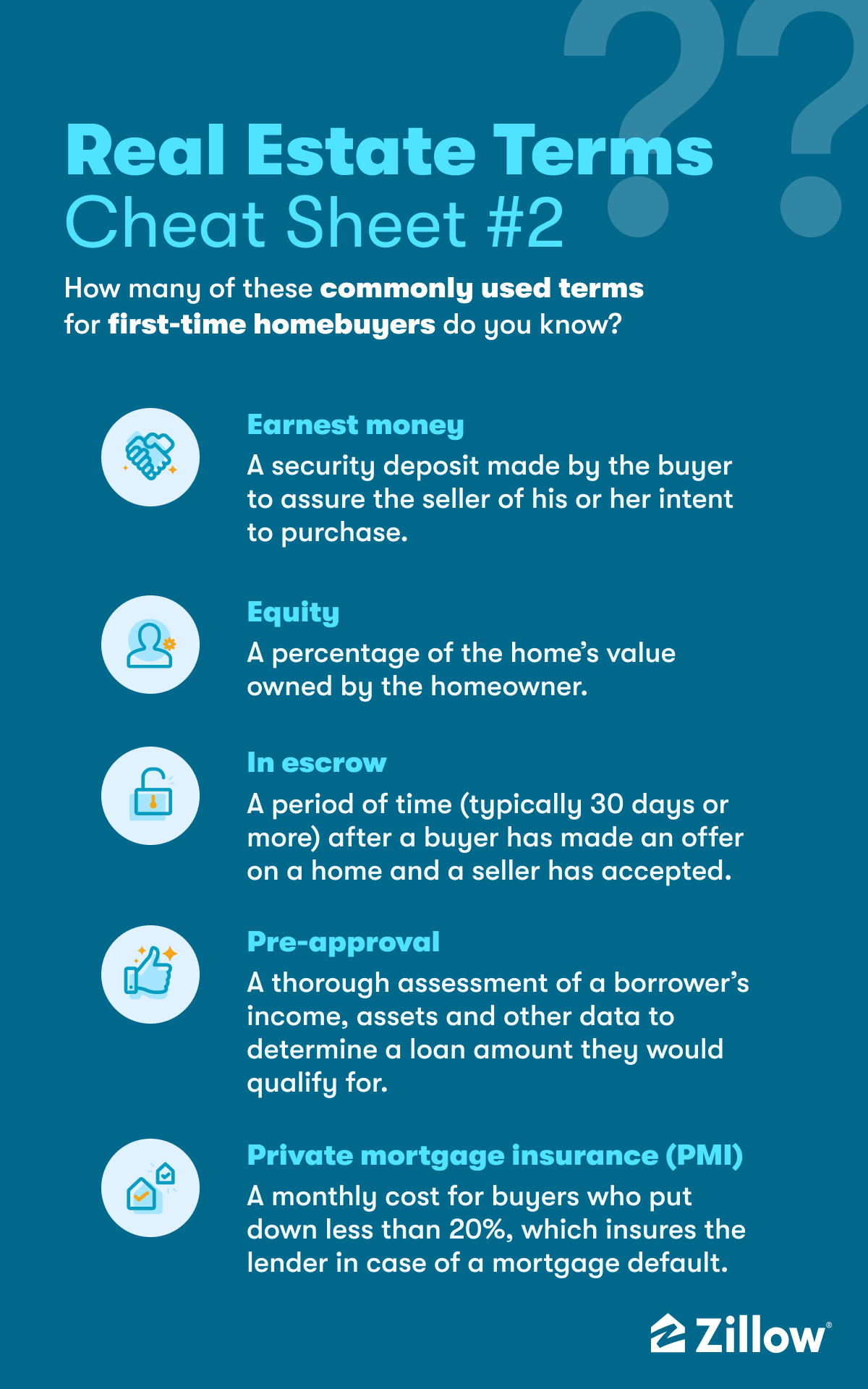

One of the key features of a home affordability calculator is its ability to incorporate debt-to-income (DTI) ratios, which are critical metrics lenders use to assess your eligibility for a mortgage. By inputting your financial data, the calculator can show you how much of your income will go toward housing costs and other debts, ensuring you don’t stretch yourself too thin. This is particularly useful for first-time buyers who may not be familiar with these financial concepts.

While many platforms offer home affordability calculators, the home affordability calculator nerdwallet provides stands out due to its simplicity and accuracy. It’s designed to give you a clear picture of your financial health and help you make informed decisions. Whether you’re planning to buy in the near future or just exploring your options, this tool can be a game-changer in your home-buying journey.

How Does the Home Affordability Calculator NerdWallet Work?

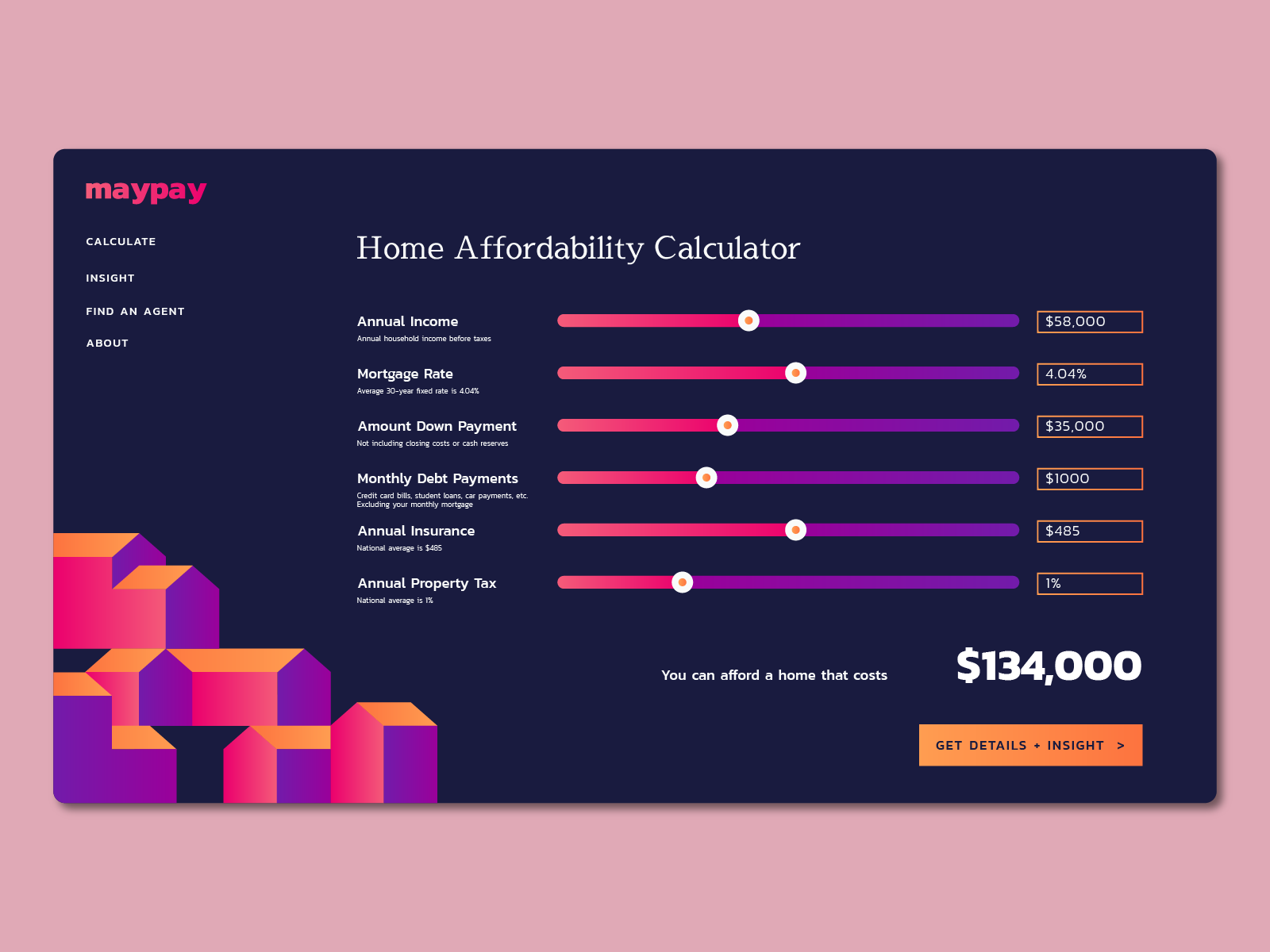

The home affordability calculator nerdwallet offers is incredibly straightforward to use. You simply input details about your financial situation, such as your annual income, monthly debts, down payment amount, and the mortgage rate you expect to qualify for. Once you’ve entered this information, the calculator processes the data and provides an estimated price range for homes you can afford. It also breaks down your potential monthly mortgage payment, including principal, interest, taxes, and insurance (PITI).

Behind the scenes, the calculator uses industry-standard formulas to determine affordability. For example, it considers the 28/36 rule, which suggests that no more than 28% of your gross monthly income should go toward housing expenses, and no more than 36% should be allocated to total debt payments. This ensures that the results are not only personalized but also aligned with what lenders typically expect.

What sets the home affordability calculator nerdwallet apart is its transparency. Unlike some calculators that provide vague estimates, this tool gives you a detailed breakdown of how each factor influences your affordability. It even allows you to adjust variables like interest rates and down payment amounts to see how they impact your results. This flexibility makes it an invaluable resource for anyone navigating the home-buying process.

Read also:Exploring The Religion Of Elon Musk Insights Into His Beliefs And Influence

Why Is It Important to Know How Much House You Can Afford?

Understanding how much house you can afford is essential for maintaining financial stability and avoiding unnecessary stress. Purchasing a home that exceeds your budget can lead to financial strain, making it difficult to cover other essential expenses like utilities, groceries, and savings. On the flip side, buying a home within your means allows you to live comfortably while still achieving other financial goals, such as paying off debt or saving for retirement.

One of the biggest advantages of knowing your affordability is that it helps you avoid overextending yourself. Many homebuyers fall into the trap of stretching their budget to get a larger or more luxurious home, only to find themselves struggling to make ends meet. By using tools like the home affordability calculator nerdwallet offers, you can set realistic expectations and focus on properties that align with your financial capabilities.

Additionally, knowing your affordability range gives you an edge when negotiating with sellers and lenders. Armed with accurate data, you can confidently make offers and secure favorable loan terms. This not only saves you money in the long run but also ensures a smoother home-buying experience overall.

What Factors Should You Consider Before Using a Calculator?

Before diving into a home affordability calculator, it’s important to consider several factors that can influence the results. These factors not only affect your affordability range but also play a significant role in determining whether you qualify for a mortgage. Let’s explore some of the most critical considerations.

Income and Debt Ratios

Your income and existing debts are two of the most significant factors lenders consider when evaluating your mortgage application. Lenders typically use your debt-to-income (DTI) ratio to determine how much you can borrow. A lower DTI ratio indicates that you have more disposable income to allocate toward housing costs, making you a less risky borrower.

- Front-End DTI: This measures the percentage of your gross monthly income that goes toward housing expenses, including mortgage payments, property taxes, and insurance.

- Back-End DTI: This includes all monthly debt obligations, such as credit card payments, student loans, and car loans, in addition to housing costs.

When using a home affordability calculator nerdwallet provides, it’s essential to have a clear understanding of your DTI ratio. This will help you input accurate data and get more reliable results.

Down Payment and Savings

The size of your down payment can significantly impact your affordability range. A larger down payment reduces the loan amount, which in turn lowers your monthly mortgage payments and interest costs. Additionally, having substantial savings set aside for emergencies and closing costs can make you a more attractive candidate to lenders.

While many buyers aim for a 20% down payment to avoid private mortgage insurance (PMI), there are options available for those who can’t save that much upfront. For example, government-backed loans like FHA loans allow for down payments as low as 3.5%. However, it’s crucial to weigh the pros and cons of these options before making a decision.

How Can You Improve Your Chances of Buying a Home?

Improving your chances of buying a home involves a combination of financial preparation and strategic planning. Here are some actionable steps you can take to enhance your home-buying prospects:

- Boost Your Credit Score: A higher credit score can help you secure better mortgage rates, reducing your monthly payments. Pay down existing debts, avoid late payments, and check your credit report for errors.

- Increase Your Savings: Aim to save at least 20% of the home’s price for a down payment, but don’t forget about closing costs, moving expenses, and emergency funds.

- Reduce Your Debt: Lowering your DTI ratio by paying off credit card balances or consolidating loans can make you a more attractive borrower.

- Research Mortgage Options: Explore different loan programs, such as conventional, FHA, or VA loans, to find the one that best suits your needs.

By taking these steps, you can position yourself as a strong candidate for homeownership and make the most of tools like the home affordability calculator nerdwallet offers.

Common Mistakes to Avoid When Using a Home Affordability Calculator

While home affordability calculators are incredibly helpful, they’re not foolproof. Misusing these tools or failing to account for certain factors can lead to inaccurate results. Here are some common mistakes to avoid:

- Overestimating Your Budget: Just because a calculator says you can afford a certain price range doesn’t mean you should max out your budget. Leave room for unexpected expenses and lifestyle changes.

- Ignoring Additional Costs: Calculators often focus on mortgage payments but may not account for maintenance, utilities, or homeowners association fees. Factor these into your budget to avoid surprises.

- Skipping Pre-Approval: A calculator can give you a rough estimate, but getting pre-approved by a lender provides a more accurate picture of what you can afford.

By avoiding these pitfalls, you can ensure that the home affordability calculator nerdwallet provides delivers results that are both realistic and actionable.

What Are the Benefits of Using NerdWallet’s Calculator?

NerdWallet’s home affordability calculator stands out for several reasons. First, it’s incredibly user-friendly, making it accessible even for those who aren’t financially savvy. The interface is intuitive, and the results are easy to interpret, which is a huge advantage for first-time buyers.

Another benefit is its accuracy. Unlike some generic calculators, NerdWallet’s tool uses real-time data and industry-standard formulas to provide precise estimates. It also allows you to customize inputs, such as adjusting interest rates or down payment amounts, to see how different scenarios affect your affordability range.

Finally, NerdWallet offers additional resources and educational content to complement the calculator. From mortgage guides to market insights, these resources empower users to make informed decisions and feel confident throughout their home-buying journey.

Frequently Asked Questions About Home Affordability

1. How accurate are home affordability calculators?

While calculators like the home affordability calculator nerdwallet provides are highly accurate, they should be used as a starting point rather than a definitive answer. Factors like lender policies and market conditions can influence your actual affordability.

2. Can I use the calculator if I have bad credit?

Yes, you can still use the calculator to get a rough estimate. However, bad credit may limit your loan options and result in higher interest rates. Focus on improving your credit score before applying for a mortgage.

3. What if I don’t have a 20% down payment?