Fort Bend County CAD plays a pivotal role in property tax assessment and administration in Texas. Understanding its functions and services is essential for property owners and residents alike. This guide will walk you through everything you need to know about Fort Bend County Central Appraisal District (CAD), from its purpose and operations to how it impacts property taxes. Whether you’re a homeowner, investor, or simply curious, this article will provide valuable insights into the workings of this vital organization.

Property taxes are a significant financial responsibility for homeowners, and the Central Appraisal District is the entity responsible for determining the assessed value of properties in the county. Fort Bend County CAD ensures that property values are assessed fairly and accurately, which directly impacts the tax bills of residents. Understanding how the CAD operates can help you navigate the property tax system more effectively and potentially save money.

In this article, we’ll explore the history, functions, and services of Fort Bend County CAD, along with practical tips for property owners. We’ll also discuss how to appeal property valuations, access tax records, and stay informed about changes in property tax laws. By the end of this guide, you’ll have a comprehensive understanding of Fort Bend County CAD and its importance in your financial life.

Read also:Discover The Magic Of Cast Dirty Dancing Behind The Scenes And Beyond

Table of Contents

- Introduction to Fort Bend County CAD

- History and Background

- Functions and Responsibilities

- Property Tax Assessment Process

- How to Appeal Property Valuations

- Accessing Tax Records Online

- Understanding Tax Rates and Exemptions

- Resources and Support for Property Owners

- Frequently Asked Questions

- Conclusion and Next Steps

Introduction to Fort Bend County CAD

Fort Bend County Central Appraisal District (CAD) is a government entity tasked with assessing property values for taxation purposes. It operates independently of local taxing authorities, such as school districts and municipalities, but its assessments directly influence the tax rates applied to properties. The CAD’s primary mission is to ensure fair and equitable property valuations, which are the foundation of the property tax system in Texas.

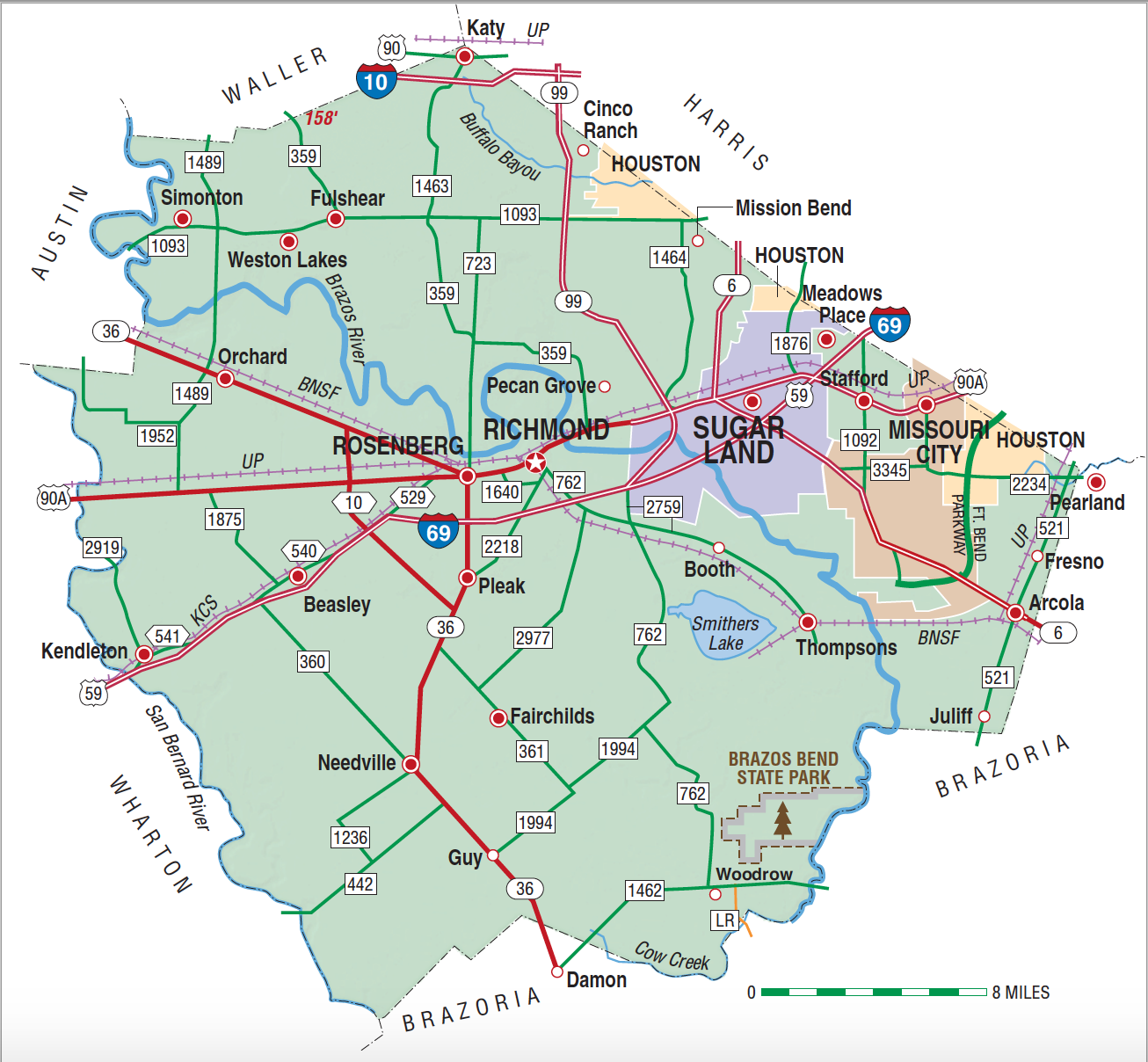

The district covers a wide range of property types, including residential, commercial, agricultural, and industrial properties. Each property is assessed based on its market value, which is determined through a combination of data analysis, property inspections, and market trends. The CAD’s work ensures that property taxes are distributed fairly among property owners, supporting essential public services like education, infrastructure, and emergency response.

History and Background

Fort Bend County CAD was established in accordance with Texas law, which mandates the creation of appraisal districts in every county. The district began operations in the early 1980s, following the passage of legislation that standardized property tax assessment practices across the state. Since its inception, Fort Bend County CAD has grown alongside the county’s population and economic development, adapting to new technologies and methodologies to improve accuracy and efficiency.

Over the years, the CAD has implemented several innovations to enhance its services. These include the adoption of geographic information systems (GIS) for mapping and property identification, as well as online portals for property owners to access their tax records and appeal decisions. The district’s commitment to transparency and accountability has earned it a reputation as a trusted authority in property tax assessment.

Key Milestones

- 1982: Fort Bend County CAD is established under Texas law.

- 1995: Introduction of GIS technology for property mapping.

- 2010: Launch of an online portal for property owners.

- 2020: Implementation of advanced data analytics for valuation.

Functions and Responsibilities

Fort Bend County CAD performs several critical functions that directly impact property owners and local governments. Its primary responsibilities include property valuation, record maintenance, and public outreach. Below is a detailed breakdown of these functions:

Property Valuation

The CAD is responsible for determining the market value of all properties within Fort Bend County. This process involves analyzing sales data, conducting property inspections, and applying standardized valuation methods. The goal is to ensure that each property is assessed at its fair market value, which serves as the basis for calculating property taxes.

Read also:Experience The Magic Wrigley Field Cam Your Ultimate Guide

Record Maintenance

The district maintains a comprehensive database of property records, including ownership information, property characteristics, and valuation history. These records are updated annually to reflect changes in ownership, property improvements, or other relevant factors. Property owners can access these records online or by visiting the CAD office.

Public Outreach

Fort Bend County CAD is committed to educating property owners about the appraisal process and their rights. The district provides resources such as informational brochures, workshops, and online tools to help residents understand how their property taxes are calculated and how to appeal valuations if necessary.

Property Tax Assessment Process

The property tax assessment process in Fort Bend County involves several steps, each designed to ensure accuracy and fairness. Understanding this process can help property owners better navigate their tax obligations and identify opportunities for savings.

Data Collection

The CAD begins by collecting data on properties within the county. This includes information on property size, location, improvements, and recent sales. The district also conducts periodic inspections to verify property characteristics and ensure that its records are up to date.

Valuation

Once the data is collected, the CAD applies standardized valuation methods to determine each property’s market value. These methods may include the sales comparison approach, cost approach, and income approach, depending on the property type and available data.

Notice of Appraised Value

After the valuation process is complete, property owners receive a Notice of Appraised Value. This document outlines the assessed value of the property and provides instructions for appealing the valuation if the owner disagrees with the assessment.

How to Appeal Property Valuations

If a property owner believes their property has been overvalued, they have the right to appeal the assessment. The appeal process involves several steps, and understanding these steps can increase the likelihood of a successful outcome.

Filing an Appeal

To initiate an appeal, property owners must file a protest with the CAD by the deadline specified in the Notice of Appraised Value. The protest form can be submitted online or in person at the CAD office.

Preparing for the Hearing

Once the appeal is filed, the property owner will be scheduled for a hearing with the Appraisal Review Board (ARB). During this hearing, the owner can present evidence to support their claim, such as recent sales data, appraisals, or photographs of the property.

ARB Decision

After the hearing, the ARB will issue a decision. If the owner is dissatisfied with the outcome, they may pursue further legal action through the court system.

Accessing Tax Records Online

Fort Bend County CAD provides an online portal that allows property owners to access their tax records conveniently. This portal includes information on property valuations, ownership details, and tax payment history. Users can also download forms, file appeals, and view important deadlines.

Benefits of Online Access

- Convenience: Access records from anywhere with an internet connection.

- Transparency: View detailed information about your property’s valuation and tax history.

- Efficiency: Submit forms and appeals electronically to save time.

Understanding Tax Rates and Exemptions

Property tax rates in Fort Bend County are determined by local taxing authorities, such as school districts and municipalities. These rates are applied to the assessed value of properties to calculate tax bills. Property owners may also qualify for exemptions that reduce their taxable value, such as homestead exemptions or senior citizen exemptions.

Homestead Exemption

The homestead exemption is available to homeowners who use their property as their primary residence. This exemption reduces the taxable value of the property by a fixed amount, lowering the overall tax bill.

Senior Citizen Exemption

Homeowners aged 65 or older may qualify for an additional exemption, which further reduces their taxable value. This exemption is designed to provide financial relief to senior citizens on fixed incomes.

Resources and Support for Property Owners

Fort Bend County CAD offers a variety of resources to help property owners navigate the appraisal and tax process. These include educational workshops, online tools, and customer support services.

Educational Workshops

The CAD hosts workshops throughout the year to educate property owners about the appraisal process, exemptions, and appeal procedures. These workshops are free to attend and provide valuable insights for both new and experienced property owners.

Customer Support

Property owners can contact the CAD’s customer support team for assistance with any questions or concerns. The team is available by phone, email, or in person at the district office.

Frequently Asked Questions

Below are answers to some common questions about Fort Bend County CAD:

What is the role of Fort Bend County CAD?

The CAD is responsible for assessing property values for taxation purposes and maintaining accurate property records.

How can I appeal my property valuation?

You can file a protest with the CAD and present your case to the Appraisal Review Board during a hearing.

What exemptions are available to property owners?

Common exemptions include homestead exemptions, senior citizen exemptions, and disability exemptions.

Conclusion and Next Steps

Fort Bend County CAD plays a crucial role in the property tax system, ensuring that property values are assessed fairly and accurately. By understanding its functions and processes, property owners can make informed decisions about their tax obligations and take advantage of available resources and exemptions.

We encourage you to explore the CAD’s online portal, attend educational workshops, and stay informed about changes in property tax laws. If you have questions or need assistance, don’t hesitate to reach out to the CAD’s customer support team. Share this article with fellow property owners and leave a comment below to share your thoughts or experiences with Fort Bend County CAD.